Information Details

Chinese medical technology expands Southeast Asian market, Singapore is the first stop

Release time:

2024-07-12 15:04

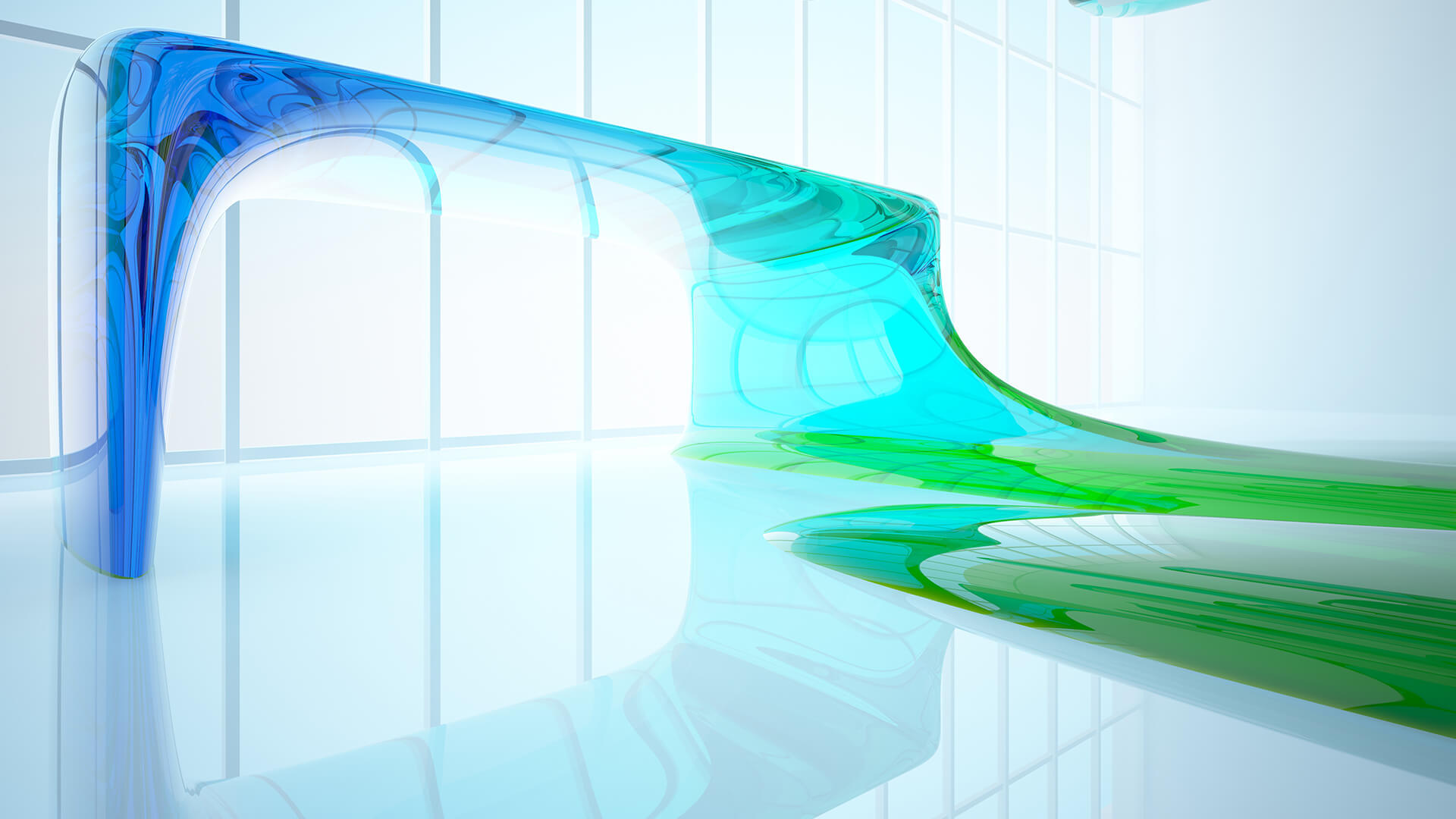

The picture shows Fang Li, assistant general manager of Suzhou Iron Technology Co., Ltd. (from left), Chen Zaijie, managing director of the international business department of OCBC Global Corporate Bank, Zhao Jingwei, chairman of Esseniot Intelligent Medical Equipment (SuZhou)LTD.Inc Chen Qing, overseas marketing director of Aixin Smart Medical Technology Development (Suzhou) Co., Ltd., and Yao Yi, chairman and chief technology officer of Suzhou Leitai Medical Technology Co., Ltd. (provided by OCBC)

In recent years, against the backdrop of geopolitical tensions, more Chinese medical technology companies have come to Singapore to discuss setting up businesses and explore the Southeast Asian market with Singapore as the center.

According to a report published by Deloitte in February 2024, the average export revenue of China's leading medical equipment companies accounts for only 20% to 30%, far lower than the global 50% to 60%. At the same time, the compound annual growth rate of Singapore's medical equipment market from 2021 to 2026 is expected to reach 8.8%, but currently only 2% of imported medical equipment comes from China.

Recently, three Chinese medical technology companies from Suzhou Industrial Park visited Singapore and the ASEAN region. In an interview with Lianhe Zaobao, they explained their insights on the strategic layout of the Southeast Asian market.

Yao Yi, chairman and chief technology officer of LinaTech LLC, a manufacturer of cutting-edge medical technology equipment, said that the company is considering using Singapore's technology and talent resources to reach cooperation with local hospitals to enhance the credibility of the brand and then radiate its business to other ASEAN countries.

He mentioned that most ASEAN countries lack medical talents who can operate high-end instruments, but this can be compensated by artificial intelligence (AI) and automation technology. The latter can assist doctors in operating equipment and reduce the cost of medical services. Singapore can provide such technical resources, and companies can set up AI skills training centers in Singapore.

Fang Li, assistant to the general manager of Suzhou Iron Technologies, said in an interview that although Singapore's local market is not large, if the project is successfully implemented in Singapore, it can serve as a model for other Southeast Asian countries and promote the overall development of enterprises in Southeast Asia.

Chen Qing, the overseas marketing director of Esseniot, revealed that the company has set up a Southeast Asian marketing and R&D center in Singapore this year in order to maintain close communication with Southeast Asian business channels and find opportunities.

Huge opportunities in the Southeast Asian medical market

Yao Yi said that compared with the country's population, all of Indonesia's cutting-edge medical equipment is far from enough according to the standards of the World Health Organization, and there is great potential demand.

Chen Qing said that European and American medical equipment products currently have an almost "monopoly" market share in Southeast Asia, but Chinese brands are more cost-effective.

Zhao Jingwei, chairman of Suzhou Industrial Park Health Industry Co., Ltd., pointed out that Chinese companies are very competitive because they can provide better emergency management, customized services and cost control while being comparable to or even surpassing Europe and the United States in terms of technological level.

Business owners: Also considering moving part of the supply chain to Southeast Asia

In terms of supply chain, most Chinese medical technology companies are still developing the Southeast Asian market through brand cooperation and intellectual property and technology sharing.

However, Fang Li pointed out that if the business demand in the Southeast Asian market is large enough and the cost considerations are suitable, the company is also considering moving part of the supply chain to Southeast Asia.

Zhao Jingwei said that although enterprises will encounter many challenges in the process of development, opportunities outweigh problems, and there are many platforms for government docking between China and Singapore, which can actively help China's innovative technology to develop in Southeast Asia.

He said that Singapore's political and economic environment and its influence on ASEAN, partnerships, including the Singapore Economic Development Board's Singapore + 1 strategy, have made many Chinese companies willing to use Singapore as the center and first stop for developing the Southeast Asian market.

OCBC Bank, which assists these three Chinese companies in developing the Southeast Asian market, recently held the Singapore Station of the "Overseas Chinese Easy Access Series" to promote exchanges between more than 10 Chinese medical technology companies and local institutions, and understand their opportunities and resources for developing the Southeast Asian market and setting up bases in Singapore.

Chen Zaijie, Managing Director of International Business Department of OCBC Global Corporate Banking, said that every company is different, so the bank's services are also customized: not only lending, but also helping customers connect to the local market, better handle payments, connect different institutions, and provide a network of contacts.

Typical Case Study